Best Time To File Old Taxes? NOW!

Believe it or not, the percentage of the taxpaying population who files late or doesn’t file at all is substantial. There have been several statistics that indicate that eleven to fourteen million taxpayers fail to file their returns on time. This could mean they do it months, if not years after the April 15th deadline. The reasons for filing late are all across the board. They range from forgetfulness and confusion on what to do to, all the way up to not sure how to pay a balance, to destruction of records. No matter what the reason, we’re going to discuss why now (through say 2021) is the best time to file those old tax returns you’ve been putting off.

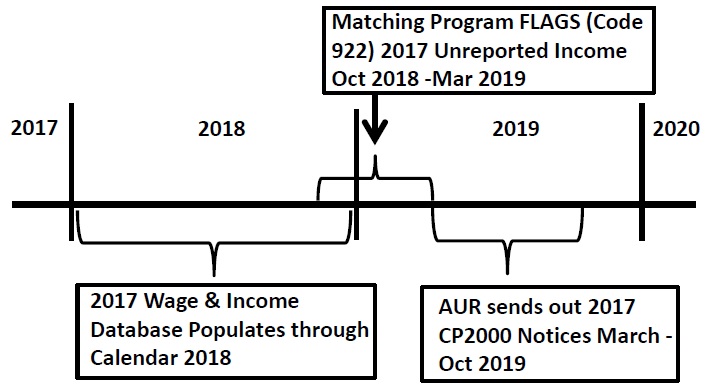

Covid-19 has slowed down IRS operations and processing times. When the Internal Revenue Service (IRS) machine is humming along in a “normal” year, its computers are busy spitting out letters to taxpayers, and its personnel attempt to collect tax debt from delinquent taxpayers. This includes audits, site visits, revenue officer contact and a host of other things. The IRS is not “fast” in the best of times and now, due to Covid-19, their operations are severely impacted. For example, from March through July 2020, the IRS computers were offline and NO mail sent to the IRS was opened. All of the above can give you “more” time to address your situation. Meaning, it can give you time to:

- Get the documents needed to have the old tax returns prepared.

- Allow you to prepare all the returns at once for submission.

- Determine if (or how much) you owe the IRS and come up with a game plan to deal with it.

- Mail or electronically file the returns with the IRS and then wait for them to catch up and respond.

If you only filed a 2018/2019 tax return for a stimulus check, but have other unfiled returns, you just put yourself back on the IRS’ radar. Those who filed tax returns but have other unfiled tax returns, just “raised their hand” so-to-speak with the IRS. Essentially, that person has now told the IRS 1) that they are still around and 2) where to send the letter asking about those other unfiled years. It’s only going to be a matter of time before they reach out to you about those missing returns. Best to use this time to perform the steps outlined in the bullet points above!

If you owe the IRS, the sooner you file, the sooner the 10 year clock for them to collect starts running. Many taxpayers, and some practitioners, are unaware that the IRS by law only has 10 years’ time to collect a tax debt. This is referred to as the statute of limitations or in IRS speak, the Collection Statute Expiration Date or CSED for short. The 10-year period begins to run with the date of the “assessment” of the tax, not the tax year for which taxes are due. For example, if a return for 2017 is not filed until 2020 and the tax is assessed in 2020, the 10-year period begins to run in 2020 and expires in 2030.

If you’re not working or have a reduced income due to Covid-19, it could result in a “deal” with regards to your tax debt. When it comes to settling ones tax debt, it all comes down to the IRS term referred to as reasonable collection potential or RCP. The RCP is how the IRS measures the taxpayer’s ability to pay on the taxes they owe. It includes the value that can be realized from the taxpayer’s assets, such as real property, automobiles, bank accounts, and other property. The RCP also includes anticipated future income, less certain amounts allowed for basic living expenses. It is the last point that can get you a deal during these “unprecedented times” we will be facing until about 2021.

You see, if you have no assets and your income is reduced, your RCP could be $0 or even negative once the IRS factors in those allowable expenses. If your RCP is in fact $0, then that means that you won’t have to pay them anything (at the moment). Why? Because the IRS will place your account into Currently Not Collectible (CNC) status. But what is also good about not having income coming in at this time is that you may be able to settle all your tax debt via an Offer In Compromise (OIC). The OIC program allows eligible tax debtors to pay the IRS an amount of money that is less than what they owe in order to wipe out their entire tax liability.

Now is the perfect time to “reset” your life and taxes. Covid-19 will force some people to hit “rock bottom” so to speak. But this is the best time to reset your life, get rid of the past and move forward. Why?

- When you hit rock bottom, you let go of everything. You start again with nothing and get rid of all the stuff in your life that doesn’t make sense.

- Pain is the momentum and the motivation you’ve probably needed to make you actually deal with your tax situation once and for all.

- Rock bottom is where your gratitude increases ten times, if not more. That’s because life is a battle and it’s not easy. It’s not meant to be a walk in the park, but it can be so much better when you appreciate all that is around you.

Need help filing those old tax returns? Why not make today the day you FINALLY deal with those old tax returns? Why not take the first step to getting that IRS monkey off your back? Take the first step RIGHT NOW and call our office or shoot us an email via the signature in our footer. We can help you get any missing documents, file your returns and even deal with the IRS debt should you owe back taxes. Trust us, you’ll feel much better once you put this behind you!