What is the IRS Matching Program?

When a taxpayer earns income, the issuing party will provide them with an IRS form. This may include a Form W2, Form 1099-MISC, Form 1099-DIV, Form 1099-INT, etc. The key thing to remember is that not only does the taxpayer receive this form, but so does the IRS. Well, at some point in time, the IRS runs “checks” to make sure that the income reported on these forms “matches” what is reported on the tax return. If there is a mismatch? Well, let’s just say that the IRS will send you a “love letter” bringing the discrepancy to your attention.

Understanding upfront matching

With this program, the IRS scrutinizes income reporting before issuing a taxpayer’s refund via the following steps:

- The IRS receives a tax return.

- The IRS matches the return against Forms W-2 and/or Forms 1099 that the IRS has received.

- If everything matches between the return and the information statements, the IRS releases the refund.

- If the IRS finds a mismatch, the IRS freezes the refund and sends a notice to the taxpayer asking for more information to prove their income and withholding.

Understanding CP2000 matching

When a tax return’s information doesn’t match data reported to the Internal Revenue Service by employers, banks and other third parties, the IRS will send a letter to the taxpayer. The letter is called an IRS Notice CP2000, and it gives detailed information about issues the IRS identified and provides steps taxpayers should take to resolve those issues.

This isn’t a formal audit notification, but a notice to see if the taxpayer agrees or disagrees with the proposed tax changes. Taxpayers should respond to the CP2000, usually within 30 days from the date printed on the notice. If a timely response can’t be made, taxpayers need to call the toll-free number shown on the notice and request additional time to respond.

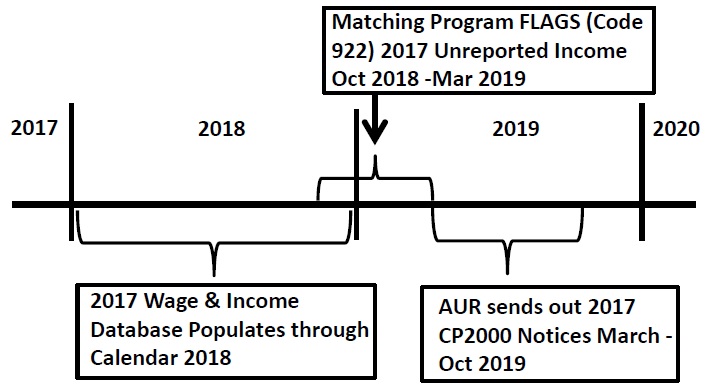

The key thing to note is that CP2000 matching doesn’t typically happen immediately unlike upfront matching. In fact, it often happens months (if not almost a year) after a tax return is filed. Let’s take a look at a 2017 tax return as an example shall we?

A tax year 2017 return was due April 15th 2018, but could have been extended until October 15th 2018. During the early part of 2018, the payor’s of income (e.g. employers, banks, etc) send their corresponding IRS forms to the IRS. These in turn, populate the Wage & Income module associated with a taxpayers account (i.e. SSN or EIN) all the way until December 31st 2018. Once the extension deadline passes (10/15), the IRS matching program will begin to “flag” unreported/under-reported income between October 2018 and March of 2019 via a code 922 on the Wage & Income transcript (i.e. review of unreported income). The IRS will then send taxpayers CP2000 notices between March and October of 2019!

What Can You Do?

To avoid a mismatch, make sure that you report all of the income that is reported on the IRS forms that you receive. If you are working with a tax advisor, make sure that you give them all the documents you receive so they can file an accurate return and report all income received in a tax year. In addition, if you discover a tax return error, make sure to amend the return as soon as possible to avoid penalties or audits.

Need Help With a CP2000 Notice of Amending A Return?

We routinely assist taxpayers when they need help “fixing” a return. Furthermore, since we deal with filing old tax returns, we have the software to go back up to 10 years if needed! So, if you need help, give us a call now via the number above or shoot us an email via the address in the footer on this page. We can help you address your letter and correct your return in as little as 48 hours.