How To Fill Out IRS Form W-9

A W-9 is used to confirm a person’s name, address, and taxpayer identification number (TIN) for employment or other income-generating purposes

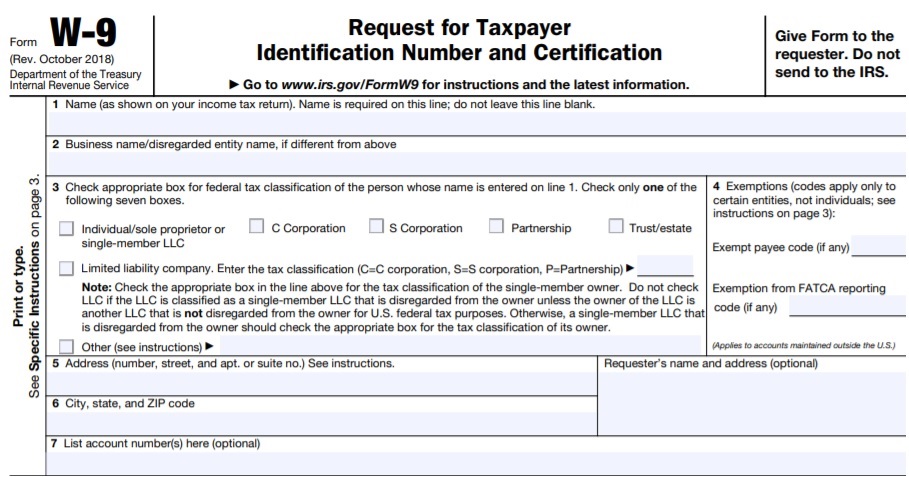

IRS Form W-9 is officially titled the Request for Taxpayer Identification Number and Certification. This form is used to provide the correct Taxpayer Identification Number (TIN) to a person (or company) that is required to file an information return with the IRS. This information return (e.g. Form 1099-MISC, Form 1098) is to report, for example:

- Non-employee compensation;

- real estate transactions;

- mortgage interest;

- acquisition or abandonment of secured property;

- cancellation of debt;

- and contributions to an IRA.

Now let’s look at the exact steps to correctly complete a Form W-9.

Line 1 of the form asks for your name. If you’re running a sole proprietorship you would enter YOUR name. To clarify this point, the name on line 1 must match with the name the IRS associates with your TIN (i.e SSN or EIN). The name on line 1 should never be a disregarded entity – a single owner LLC.

If you have a business name, trade name, doing business as name or disregarded entity name you can enter it on line 2 business name.

On line 3, select just ONE box. Check the appropriate box for the U.S. federal tax classification of the person whose name is entered on line 1. For example, let’s say that Jared Rogers is the name on line 1. However, Jared owns and does business as Jared’s Dirty Little Secret LLC. Since the LLC is owned only by Jared, he would check the “Individual/sole proprietor or single-member LLC” box on line 3. By contrast, of the LLC was owned by 2 people, then the would check the “Limited liability company” box and enter in P (for Partnership) in the box to the right.

Line 4 is for exemption codes. Exemption codes are for those payments that are exempt from backup withholding. Usually, individuals aren’t exempt from backup withholding. Corporations are exempt from backup withholding for certain payments. Refer to the instructions provided with Form W-9 for the appropriate code to use if you believe your business is exempt from potential backup withholding.

In line 5, enter your address. If you have already provided the requester an address and this is a new address write “new” at the top. If you discover that the requester has been using the wrong address or TIN for your business, let the requester know as soon as possible and provide the correct information.

Enter your city, state and zip in line 6. Line 7 is optional. Some businesses have multiple accounts with a vendor and this line is available to specify which account this W-9 pertains to.

You’ll complete Part I next. Enter your SSN, EIN or individual taxpayer identification as appropriate. If you’re asked to complete Form W-9 but don’t have a TIN, apply for one and write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. Requestors of Form W-9 will have to deduct backup withholding from any payments that are subject to it until you provide your TIN.

Next, you’ll complete Part II. This is where you sign when required. Form W-9 is officially titled Request for Taxpayer Identification Number and Certification. By signing it you attest that:

- The TIN you gave is correct. This can be a Social Security number or the employer identification number (EIN) for a business.

- The taxpayer (you, the payee) isn’t subject to backup withholding.

- You’re a U.S. citizen or other U.S. person.

- Any FATCA (Foreign Account Tax Compliance Act) codes on the form are correct. FATCA reports are required of U.S. citizens to report foreign financial assets held outside the U.S.

- If you’re a recipient of payments that are reported in Box 5 or Box 7 for nonemployee compensation on Form 1099-MISC you must give your correct TIN. You must sign the certification if you’ve been notified that the previously provided TIN is incorrect, or there is a problem with the information provided to the IRS at an earlier date.

Although Form W-9 is a standard tax document and by itself, it doesn’t pose many problems, there are a few situations worth watching for.

- Make sure a person knowledgeable about your business is filling out the form.

- If you’re starting a new job and your employer hands you a W-9, ask if you’ll be working as a self-employed independent contractor or as an employee. Employees complete Forms W-4, not Forms W-9, to set their tax withholdings.

- Make sure you understand and agree with the worker classification the requestor has in mind.

- If you’re unsure why you’re being asked to complete the form, ask what types of tax documents you can expect to receive when the information is used. Form 1099-Miscellaneous, for example or Form 1099-DIV.

- Make sure the person taking your information is authorized to do so.

You should always exercise caution when giving out sensitive information like your name, address, SSN or EIN so take steps to transmit W-9 information securely. Protect the confidential information by sending it via an encrypted email, by hand delivery, or by mail.

You might have other questions as you complete a Form W-9. With that said, it’s advisable to download the instructions and review them prior to completing and submitting the form to the requestor.